Everything You Need to Know about NNN

Whether you’re looking to lease or invest in commercial real estate, you’ve probably run across the term “triple net.”

But what does that actually mean?

The commercial real estate is so full of its own jargon that it can be difficult to keep up when you’re new to the game.

So, here’s the complete guide on everything you need to know about NNN (triple net).

What Does NNN Mean?

Triple Net, often abbreviated as “NNN,” is a type of lease structure where the tenant or lessee agrees to pay additional expenses related to the operations of the property, including common area maintenance, property taxes, and building insurance.

These additional expenses, each of which is one of the three “nets,” are often referred to as Additional Rent. This additional rent is most commonly paid on a monthly basis with the base rent.

The NNN style of lease is most commonly found in retail real estate, but can also be utilized in industrial and office leasing, as well.

There are several different types of net leases, each of which has a varying degree of responsibility placed onto the tenant with regards to the property’s expenses.

Common Area Maintenance

Common Area Maintenance (CAM) expenses are is an additional rent expense paid by tenants to landlords to cover costs associated with the overhead and operating expenses for the common areas of the property.

These common areas are spaces used on a non-exclusive basis by any and all of the property’s tenants and include, but are not limited to, property management, parking lots, landscaping, hallways, elevators, lobbies, shared bathrooms, and security.

Property Taxes

Property taxes are taxes collected by local governments usually based on the appraised value of a property. The tax collected is typically used to support community safety, schools, infrastructure, and other public projects.

Building Insurance

Building insurance is an insurance policy carried by the landlord to cover the financial cost of repairing or replacing, if necessary, the structure of a property due to physical damage or theft. This coverage includes the roof, floors, and walls, as well as any fitted or permanent fixtures (i.e. a fitted kitchen).

Responsibilities Under a NNN Lease

Landlord and tenant responsibilities under a NNN lease will depend on the degree of the NNN lease structure. Here’s a broad overview of the responsibilities of each party:

Landlord Responsibilities

Triple Net lease structures are heavily in the landlord’s favor since they are not responsible for bearing the expenses of owning or operating the property.

However, landlords are often still responsible for paying a mortgage and maintaining the structural aspects of the property, which can include the foundation, structural walls, and roof.

The landlord or the landlord’s representative, which is often a property management company, will be responsible for overseeing the common area maintenance of the property, which can range from ensuring the lawn is clean cut and presentable to salting sidewalks before / during a freeze.

Tenant Responsibilities

Tenants bear the majority of expenses when it comes to a NNN lease.

Fortunately, unless the lease is Absolute Net, which we’ll cover under different types of net lease structures, the tenant is only responsible for paying for and not actually performing the maintenance of the property.

Tenants also don’t have to keep up with when to pay property taxes and maintain a building insurance policy.

Triple net leases are essentially net of all expenses to the property owner, so the tenant will be responsible for paying for their pro rata or exclusive share of any operating expenses on the property.

When Is a Triple Net Lease Structure Used?

As I stated earlier, NNN leases are most often found in retail but can be used in any type of commercial real estate where the tenant has its own, private space.

Landlords prefer to use this type of lease structure because it alleviates the liability of common area maintenance, taxes, and insurance from their expenses and passes it on to the tenants that actually utilize the property.

But there are actually tenants that prefer this structure, too.

Starbucks, for example, will often sign an Absolute Net lease, where they’re responsible for the NNN expenses and the building structure. Why would they do that? Well, it gives them full control to maintain the aesthetic and condition of the property, in turn preserving their brand image.

How Do You Calculate NNN Expenses?

It’s important for both landlords and tenants to understand how NNN expenses are calculated.

These expenses are a form of additional rent and are not intended to be a profit center for the landlord. Landlords are simply passing-through the expenses to the tenants as they are received.

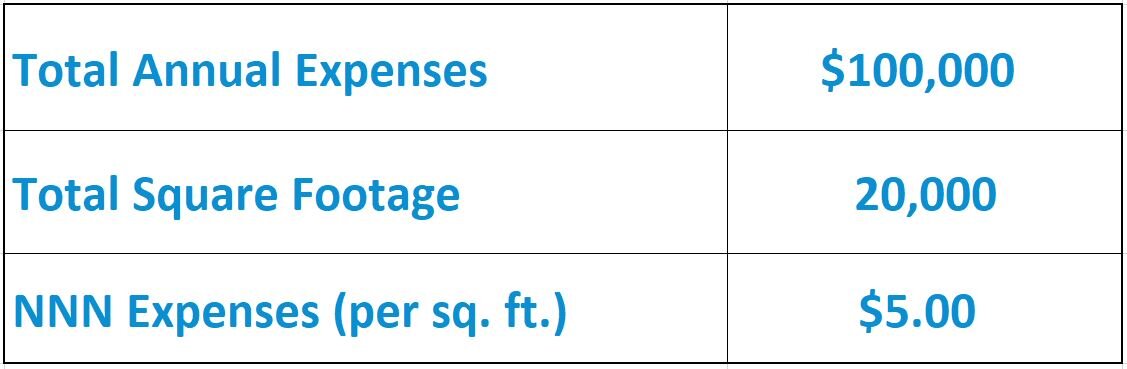

NNN leases are calculated by adding the estimated common area maintenance expenses, annual property taxes, and the building insurance for the property. This number is then divided by the total square footage of the building and given to the tenants on a per square foot basis.

For example, if a shopping center’s total annual NNN expenses are estimated to be $100,000 and the property is 20,000 square feet, tenants will pay additional rent in the amount of $5.00 per square foot.

Why Is This Number an “Estimate?”

While property taxes and building insurance are fixed expenses (meaning you know what they will be every year, or at least well in advance), common area maintenance is not a fixed expense.

There are far too many factors that go into operating and maintaining a property for the landlord and their accounting team to properly determine what that number will be. Landscaping can fluctuate, electricity expenses could rise, and unexpected expenses, such as having to salt a parking lot due to snow or ice, can cause the CAM fee to be higher.

So, landlords will provide tenants with an estimated NNN fee based on the previous year’s number, which will often get them close enough.

At the end of each year, tenants and landlords may audit the expenses to determine if there was an overcharge or an undercharge and true up appropriately.

What Are The Different Types of Net Leases?

There are several different types of net leases – and they’re often confused or blended together.

While each type does place more responsibility on the tenant, that responsibility is placed in varying degrees. So, here are the different types of net leases:

Absolute Net Lease

Absolute net leases are among the most passive investments a commercial real estate investor could have in their portfolio.

These leases are often on single-tenant occupied buildings, such as a Panera Bread or Dollar General, where the tenant is fully responsible for not only the common area maintenance, property taxes, and building insurance, they’re also responsible for maintaining the structural aspects of the property.

These investments are beneficial for both the tenant and the landlord because the tenant has the capability to maintain the property to brand standards while the landlord collects mailbox money.

Developers will construct a building specifically for a tenant and sign a longer-term lease (often 10-20+ years). The tenant takes command of a new building, so they know that as long as they maintain the property their expenses will lower, and the developer sells the property based on a cap rate of the lease value.

Double Net Lease

The double net lease isn’t as common as an absolute or triple net lease structure, but you can and will find these projects if you’re looking for investments.

In a NN lease, the tenant is usually responsible for paying property taxes and building insurance while the landlord maintains the common area. However, you can see variations of this with any combination of two of the nets.

These lease structures can be found in newer construction projects where the landlord has a builder’s warranty covering the roof and structure, which limits their liability for maintenance expenses, as well as on industrial properties where there is very little common area to maintain.

Because of the extra liability on the landlord, though, these investments trade at a slightly higher cap rate than their NNN or absolute net counterparts.

Triple Net Lease

The triple net lease is the most common of the net leases, as it can be found in shopping centers, single-tenant buildings, and more.

In a NNN lease structure, the tenant is responsible for paying the common area maintenance, property taxes, and building insurance on the property, as well as any other expenses directly related to their utilization of the property, such as utilities.

Tenants are often responsible for their own HVAC units and storefronts, too, but typically don’t have to maintain the structural aspects of the property.

Investing in NNN Properties

NNN properties are among a favorite for investors across the country.

Not only are their expense obligations lower than with other lease structures, they also have less responsibility to oversee day to day operations, so investors can buy in markets in which they don’t live.

Because of the way these leases are structured, NNN lease investments are essentially inflation-protected bonds usually guaranteed by a credit tenant. The tenant’s credit has a direct correlation to the investment’s overall value due to the risk they may provide in making (or not making) rent payments.

Landlords receive monthly rent payments from the tenants, while the real estate appreciates and provides the investor protection against inflation, typically through pre-negotiated rent bumps.

NNN investments also provide tax benefits.

Although NNN leases can be treated like a bond, they are still commercial real estate investments and therefore can be depreciated just like any other income-producing property. As the investor, you will have to pay back any depreciation when you sell the asset. However, you can put off your capital gains tax by evoking a 1031 exchange and placing that capital into another like-kind property.

Since you can finance your investment in a NNN leased property, you will also have the ability to write off any interest payments from your loan.

Share This Article:

About The Author:

Tyler Cauble, Founder & President of The Cauble Group, is a commercial real estate broker and investor based in East Nashville. He’s the best selling author of Open for Business: The Insider’s Guide to Leasing Commercial Real Estate and has focused his career on serving commercial real estate investors as a board member for the Real Estate Investors of Nashville.

In 2008, the city of Chicago sold off the rights to 36,000 parking meters for $1.15 billion. At the time, officials praised it as a financial lifeline—a way to plug a massive budget deficit without raising property taxes. But by 2025, the investors behind that deal had already earned back every dollar… plus $500 million in profit. And the kicker? They still had 60 years left on the contract.

Chicago didn’t just lose out—it got absolutely fleeced.

This wasn’t a one-off oversight. It was a glaring case of what happens when institutional leaders misunderstand the quiet power of boring real estate. Because what looked like an outdated relic—coin-operated meters on slabs of city asphalt—turned out to be one of the most lucrative investments in modern American history.

But this story isn’t really about Chicago. It’s about the invisible empire that grew underneath America’s cities—parking lots, storage yards, fenced land—and the people who saw their value long before Wall Street did.

The investors who win in commercial real estate aren’t always the ones chasing the flashiest properties. They’re often the ones who ask the simplest question: “Can I charge rent on that?”

This is the story of how surplus land and painted asphalt built billion-dollar fortunes—and how the exact same principle is quietly shaping the next wave of wealth in commercial real estate.