How to Calculate Commercial Real Estate Investment Returns

If you’re investing in commercial real estate, you’re looking for a return on your capital.

And one of the most attractive aspects of having commercial real estate investments is that you can receive monthly dividends through cash flow while hopefully gaining appreciation on the property.

But how do you determine which investment you should take on next or how your current portfolio has performed after acquisition?

Here’s how to calculate commercial real estate investment returns.

Return on Investment (ROI) or Cash on Cash

The ROI or cash on cash return is the most commonly utilized investment measurement in all of real estate.

Return on investment is calculated by taking the monthly or annual cashflow of an asset and dividing it by the total amount of money you invested into a property.

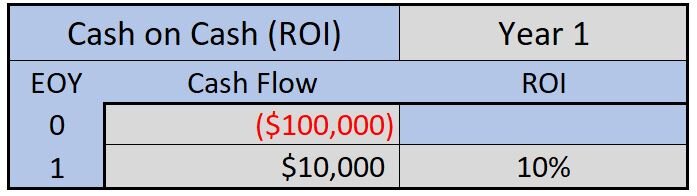

For example:

$10,000 in cash flow divided by $100,000 down payment = 10% cash on cash

In this scenario, your investment is giving you 10% of the original amount of money you invested every year - not a bad deal!

You could also throw cap rates into this category, since they’re technically a cash on cash return if you were to buy a property with all cash and no debt.

Benefits of ROI

There’s a reason the cash on cash return is the most commonly used measurement in real estate.

It’s very simple to understand.

It gives you a quick snapshot of the profitability of a deal in a way that is easily compared to the stock market or other investment vehicles.

And the ROI is just a great way to determine returns since it’s based on the cash out of pocket you will be deploying.

Drawbacks of ROI

While the simplicity of the cash on cash return is a benefit, it’s also a drawback.

The ROI only gives you a measurement of return based on the initial investment you made into the property at a specific point and time.

Your time value of money isn’t taken into account, which isn’t too important for some investors, and it also doesn’t measure your return based on your built up equity in the property.

Internal Rate of Return (IRR)

The internal rate of return is a more high-level investment measurement.

This measurement takes your initial investment, cash flow distributions, and the length of the investment into account in order to determine your returns over time.

There’s no simple way of actually calculating IRR, so I recommend using a computer program like Excel.

For example:

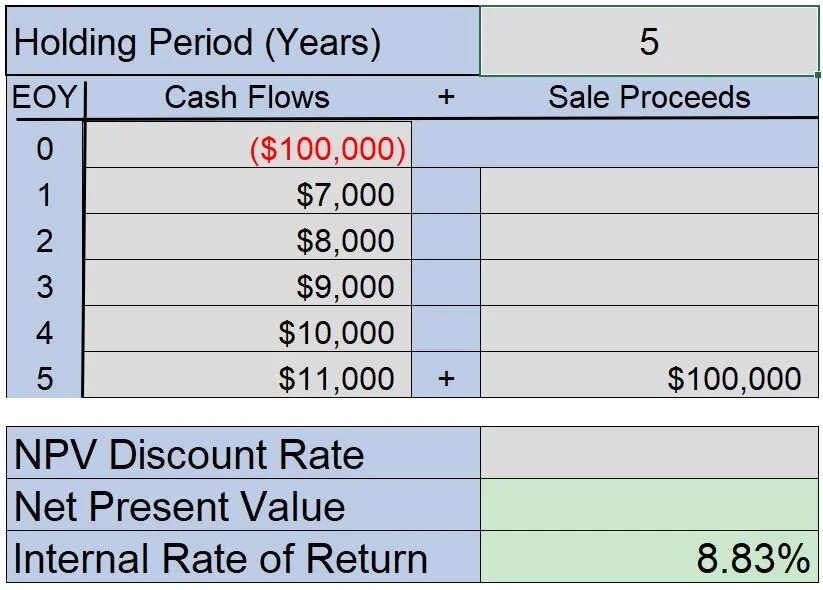

In this scenario, you make a $100,000 investment for a period of 5 years.

You’ve received $45,000 in cash flow, which some investors would equate to a 45% cash on cash return over the 5 year period.

But since IRR takes into account the amount of money you have invested over that time period, you’ll see that the return according to the IRR is actually 8.83%.

Benefits of IRR

Internal rates of return account for the amount of time that your money is invested.

Unfortunately, while the cash on cash return is helpful to determine the initial quality of an investment, it’s only a snapshot - frozen in time.

Utilizing IRRs gives you the opportunity to compare the different lengths of investments, as well as their prospective returns, to help you determine which direction is best for you to take.

Drawbacks of IRR

Calculating your internal rate of return can be very complicated.

It’s not a measurement that you can simply perform in your head while looking at a prospective investment - you will have to add it into your underwriting spreadsheets.

Your IRR calculation will also take into account future cash flows and estimated sales costs, which are uncertain.

Return on Equity (ROE)

The return on equity is arguably the most forgotten measurement of investment returns but it should be at the top of every sophisticated investor’s list.

ROE takes into account your total equity, including equity that has built up over time, and measures your cash on cash returns against that instead of your initial investment.

For example:

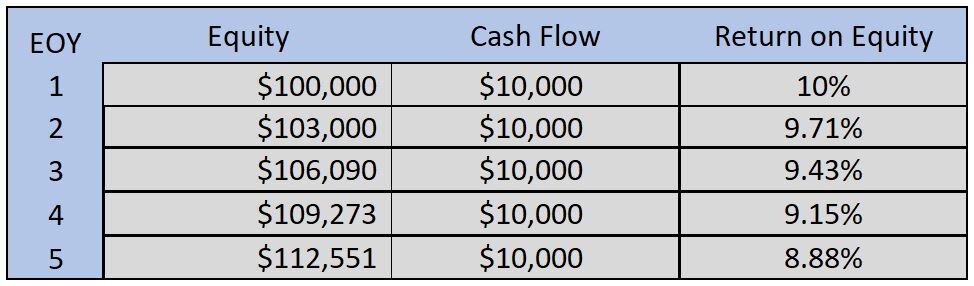

You buy a property and have $100,000 in equity.

As your property appreciates by 3% each year, your cash flow remains the same at $10,000 per year, but your return on equity decreases.

You’re building up equity in the property while your cash flow remains the same, so while you may have had a strong initial return on investment, each year that number will decrease.

You now have “captive” equity that you’ve created in this project but isn’t returning you anything on your investment, so you can choose to either refinance or sell the property in order to put that capital into play.

These types of investments are very common among triple net (NNN) properties where the rent remains flat for extended periods of time.

Benefits of ROE

Your ROE will give show you if you have capital in play that isn’t giving you a strong enough return.

At some point during your investment, you will cross a threshold where the returns on the built up equity are lower than other opportunities you may have.

Return on equity can tell you when it’s time to pull that capital out or divest of that project.

Drawbacks of ROE

While return on equity is an excellent measurement, it tells you returns based off of what I like to call “phantom” equity.

Sure, the equity is there in the property, but you either have to sell the property to realize the gain from the equity, refinance, or take out a line of credit.

It’s nice to know that you have more capital created in the project, but it can be frustrating if you don’t have any opportunities out there to move into.

So, Which Is Best: ROI, IRR, or ROE?

Well, that’s an excellent question.

Sophisticated investors will be utilizing all three of these consistently throughout each project in order to better monitor their money as it works for them.

Every investor will have their favorite real estate calculation, though, depending on the type of investments they’re making.

One nice aspect of these measurements is that they give you a different view of your returns at each stage of your investment: before, during, and after.

I recommend using all three throughout the life of your project so that you can maximize your potential investment returns.

About The Author:

Tyler Cauble, Founder & President of The Cauble Group, is a commercial real estate broker and investor based in East Nashville. He’s the best selling author of Open for Business: The Insider’s Guide to Leasing Commercial Real Estate and has focused his career on serving commercial real estate investors as a board member for the Real Estate Investors of Nashville.

If you're serious about real estate investing, it's time to look beyond those quaint single-family homes.

Bold statement? Absolutely. But stick with me here.

Now, don't get me wrong. Investing in a single-family home beats twiddling your thumbs on the sidelines of the real estate game. And yes, I'll even go out on a limb and say that residential real estate still outshines many other investment vehicles out there.

But that's not why we're here today, is it?

I'm about to lay out five reasons why commercial real estate should be your go-to play.