In 2008, the city of Chicago sold off the rights to 36,000 parking meters for $1.15 billion. At the time, officials praised it as a financial lifeline—a way to plug a massive budget deficit without raising property taxes. But by 2025, the investors behind that deal had already earned back every dollar… plus $500 million in profit. And the kicker? They still had 60 years left on the contract.

Chicago didn’t just lose out—it got absolutely fleeced.

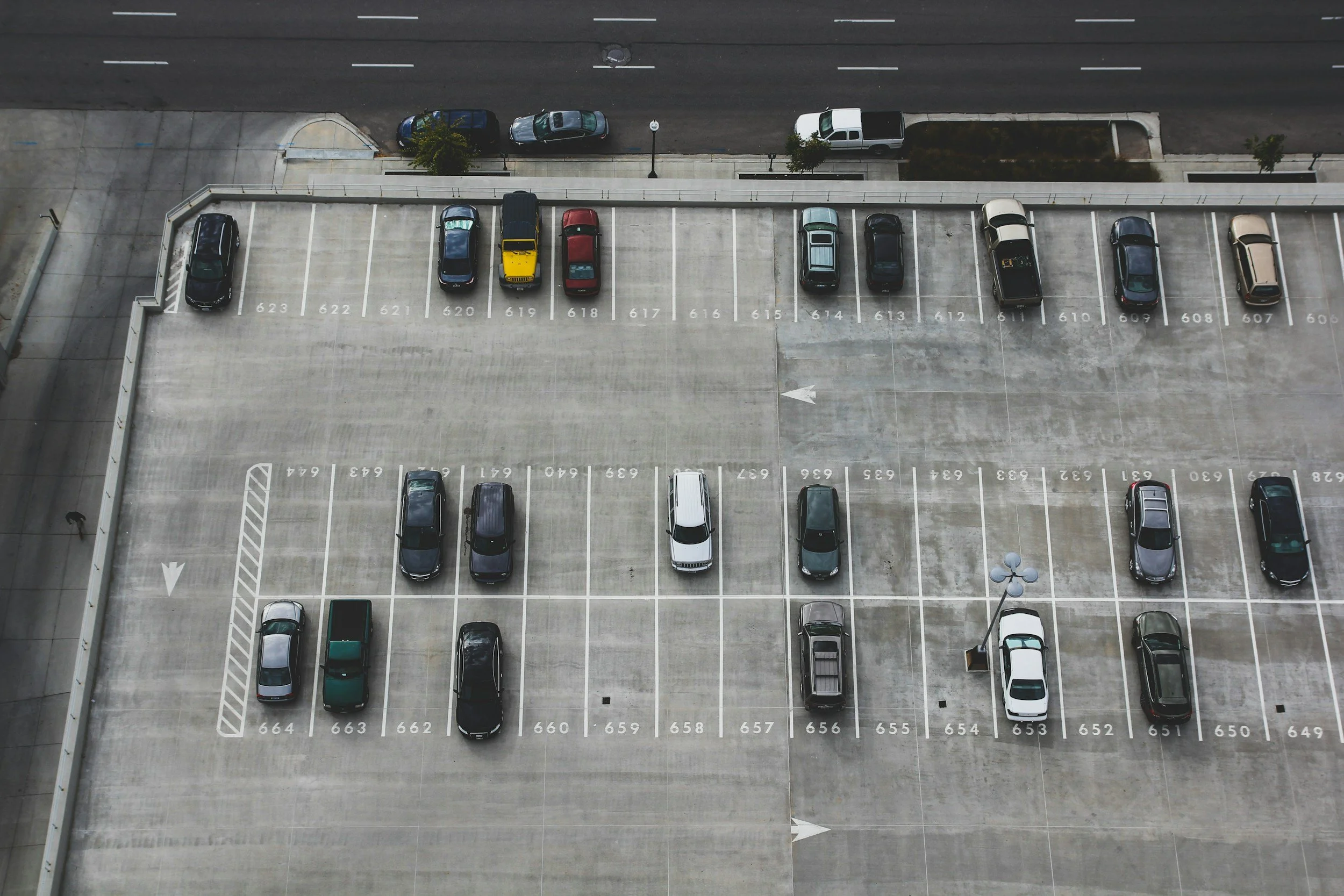

This wasn’t a one-off oversight. It was a glaring case of what happens when institutional leaders misunderstand the quiet power of boring real estate. Because what looked like an outdated relic—coin-operated meters on slabs of city asphalt—turned out to be one of the most lucrative investments in modern American history.

But this story isn’t really about Chicago. It’s about the invisible empire that grew underneath America’s cities—parking lots, storage yards, fenced land—and the people who saw their value long before Wall Street did.

The investors who win in commercial real estate aren’t always the ones chasing the flashiest properties. They’re often the ones who ask the simplest question: “Can I charge rent on that?”

This is the story of how surplus land and painted asphalt built billion-dollar fortunes—and how the exact same principle is quietly shaping the next wave of wealth in commercial real estate.