Live-Work Space

Live-work space is any type of real estate that is zoned for both residential and commercial uses.

Most zoning codes (and therefore, most projects) are either one or the other - restricting your ability for both.

The convenience to live and work in the same space is a rarity in Nashville these days.

It's not very often that you'll come across a project suitable for this use, but new construction is picking up.

With traffic on the rise and the freedom to work from anywhere, many entrepreneurs are looking to an "all in one" solution with live-work space.

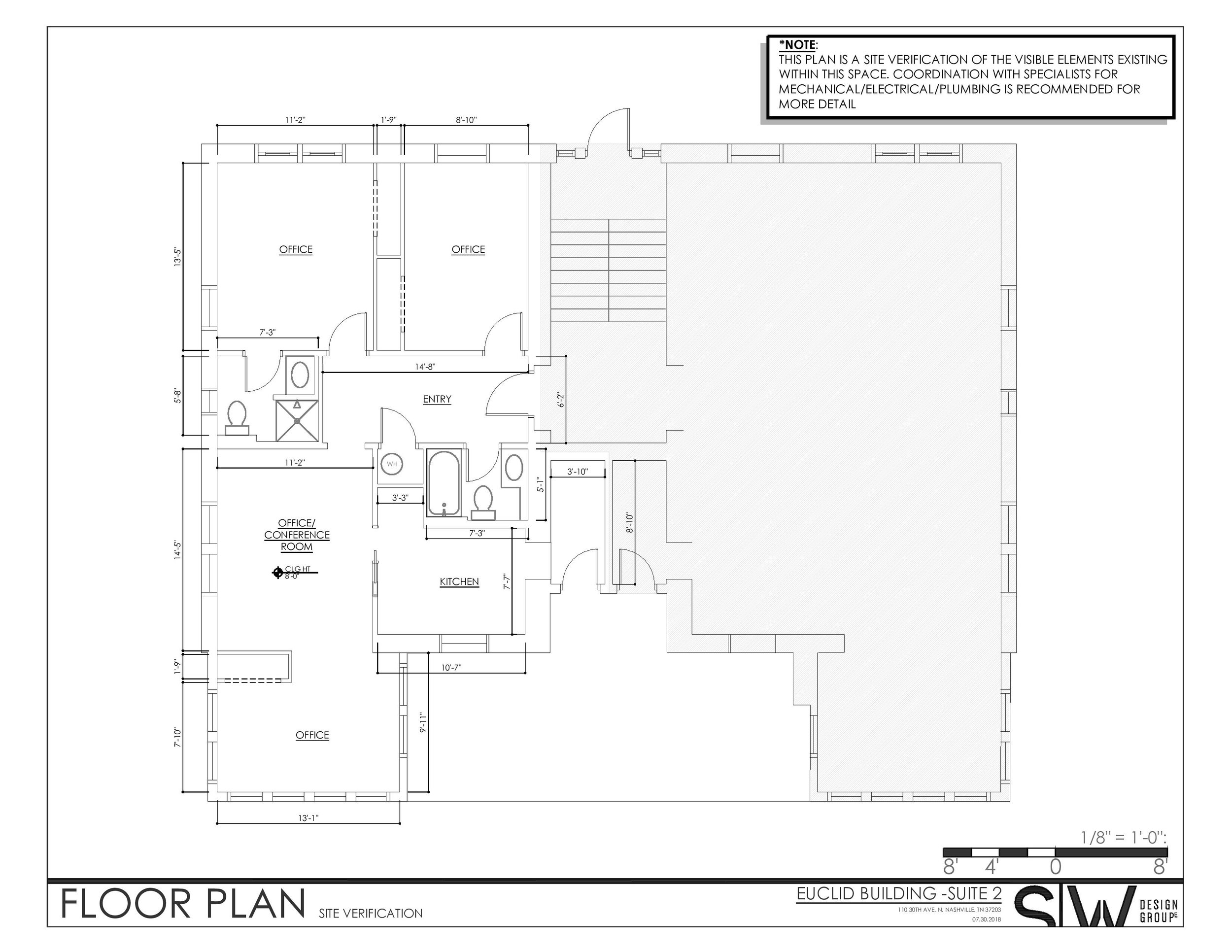

110 30th Avenue North

110 30th Avenue North, also know as Euclid Court, is zoned Office/Residential Intensive - allowing for both residential and commercial occupants.

Located one block off West End, Euclid Court is walking distance to Duet Boutique, Bricktop's, and Centennial Park.

Midtown is a shopping and business hub, thanks to Vanderbilt University and ease of access to I-440 / I-65.

You're also only 10 minutes from downtown - not to mention 21st Ave and Hillsboro Village.

What's Available at Euclid Court

The owners prefer to lease 110 30th Ave North but will also consider a sale.

The condo is 1,196 square feet and features two bedrooms (or offices), two full baths, a living room, a study, and a full kitchen with storage.

The suite is well-balanced between an open and private floor plan and has abundant light since it's a corner unit.

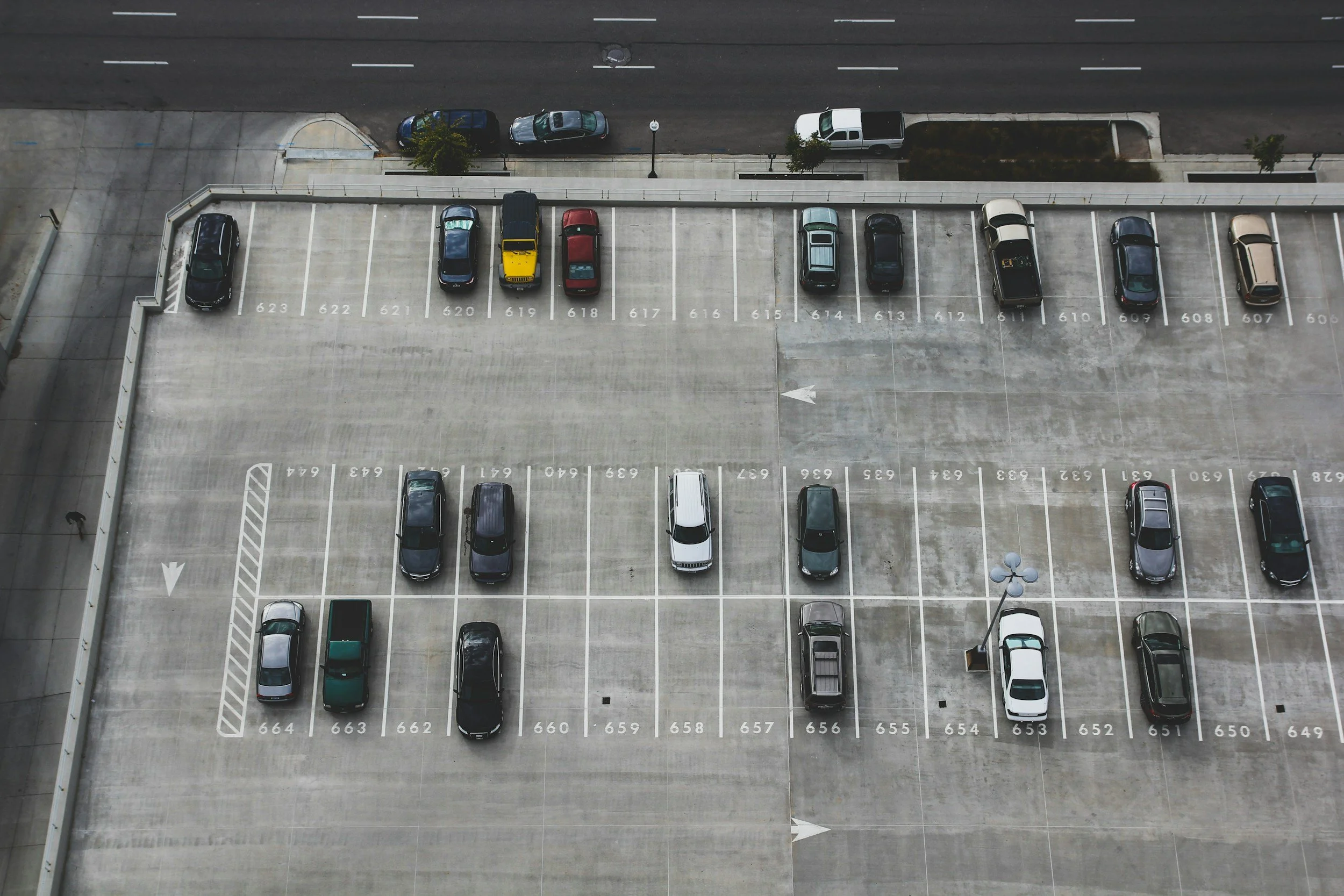

One assigned parking spot comes with the unit and there is open street parking on all sides of the building.

Looking for a location convenient to the amenities of midtown where you can live and work?

You've found it here.

In the video at the center of this post, the argument isn’t “multifamily is dying.” It’s something more subtle - and far more important for serious investors.

Rather than fear-mongering or dramatic predictions, the video highlights that the multifamily investment model that dominated the last decade is quietly evolving. What used to be a relatively straightforward play — buy apartments, collect rents, refinance, repeat — is now being reshaped by forces beneath the surface that most investors don’t talk about enough. The narrative isn’t about fundamentals suddenly disappearing — demand for housing, rent rolls, and occupancy rates remain generally solid - but about what’s changed in capital markets, regulation, and operating economics that are redefining how returns get made today.

Instead of dramatic crashes or hype, the video shows a sector in transition - where the old assumptions about underwriting, leverage, and pricing power no longer hold as reliably as they once did. It’s a reality check rooted in structural shifts rather than emotion-driven narratives. And that’s important: this isn’t about condemning multifamily, it’s about understanding the new game being played.

That sets the stage for this post: not to scare you, but to explain what’s changing underneath the headlines - so you can see where risk is really hiding, and where opportunity still exists.

Why This Question Suddenly Matters Again

For the better part of a decade, “multifamily is the safest asset class” has been repeated so often it’s started to sound like a law of nature.

Need stability? Buy apartments.

Want recession resistance? Buy apartments.

People always need a place to live, right?

But over the last 24 months, that narrative has started to crack.

Interest rates doubled. Floating-rate debt crushed operators. Insurance premiums spiked. Cap rates expanded. Syndicators that looked like geniuses in 2021 suddenly found themselves handing properties back to lenders in 2023 and 2024.

So the question is back on the table:

Is multifamily still the “safest” way to invest?

And if you’re serious about building long-term wealth in commercial real estate — not just chasing trends — this question matters more than ever.

If you spend enough time in commercial real estate, you’ll notice something strange.

Every strategy sounds convincing.

Buy multifamily - it’s recession resistant.

Buy industrial - e-commerce is unstoppable.

Buy retail - high yields.

Buy triple-net - passive and predictable.

Develop ground-up - create equity.

Value-add - force appreciation.

The advice never stops.

And for most investors - especially those trying to scale - that creates a quiet kind of paralysis. Too many asset classes. Too many opinions. Too many people confidently explaining why their strategy is the right one.

But here’s the uncomfortable truth:

The problem isn’t deal selection.

It’s strategic confusion.

Most investors are choosing assets before they’ve chosen a strategy. They’re asking, “What should I buy?” instead of asking, “What kind of investor am I trying to become?”

And that’s where a surprising comparison becomes useful.

McDonald’s and Starbucks built global empires using completely opposite real estate strategies.

McDonald’s owns the land.

Starbucks leases almost everything.

One optimized for control.

The other optimized for flexibility.

Both won.

So the real question isn’t which strategy is better.

The real question is this:

What does their difference teach us about how to think as investors?

Because great investors don’t copy companies.

They copy frameworks.

And this month, we’re breaking down one of the most important frameworks in commercial real estate:

Control vs. Flexibility.

Before you choose your next asset class, you need to choose your strategy.

Let’s start with the paradox.

In 2008, the city of Chicago sold off the rights to 36,000 parking meters for $1.15 billion. At the time, officials praised it as a financial lifeline—a way to plug a massive budget deficit without raising property taxes. But by 2025, the investors behind that deal had already earned back every dollar… plus $500 million in profit. And the kicker? They still had 60 years left on the contract.

Chicago didn’t just lose out—it got absolutely fleeced.

This wasn’t a one-off oversight. It was a glaring case of what happens when institutional leaders misunderstand the quiet power of boring real estate. Because what looked like an outdated relic—coin-operated meters on slabs of city asphalt—turned out to be one of the most lucrative investments in modern American history.

But this story isn’t really about Chicago. It’s about the invisible empire that grew underneath America’s cities—parking lots, storage yards, fenced land—and the people who saw their value long before Wall Street did.

The investors who win in commercial real estate aren’t always the ones chasing the flashiest properties. They’re often the ones who ask the simplest question: “Can I charge rent on that?”

This is the story of how surplus land and painted asphalt built billion-dollar fortunes—and how the exact same principle is quietly shaping the next wave of wealth in commercial real estate.

If you’ve been investing for a while, you know the grind.

You’ve closed deals, managed contractors, worked through leases, and seen both wins and setbacks. Maybe you’ve owned single-family rentals, a few duplexes, or even some small commercial buildings. You understand the fundamentals: how to run numbers, navigate debt, and keep properties occupied.

But here’s a question that hits at a different level: are your investments giving you leverage or just more responsibility?

As your portfolio grows, so does the complexity. More tenants often mean more phone calls. Bigger buildings bring additional systems, staff, and liability. And while your equity might be growing on paper, your time can get stretched thin across too many directions.

That’s why more experienced investors are quietly shifting toward asset classes that offer something rare in commercial real estate: simplicity that still delivers strong returns.

Two of the most overlooked categories in this space are flex industrial and industrial outdoor storage (IOS).

They’re not flashy. You won’t find them in luxury investor decks or high-end brochures. But these properties produce solid returns, attract long-term tenants, and are surprisingly light on operational headaches. Best of all, they give seasoned investors a way to keep growing without being consumed by the demands of their portfolio.

In this post, we’ll walk through:

What makes flex and IOS so attractive

The numbers behind why they work

How they fit into a growing portfolio

And why they might be the most strategic asset class you haven’t explored yet

This is not about going bigger for the sake of scale. It’s about going smarter.

Because the goal is not more units. It’s more freedom.

“Most people think about their first deal. Few think about their last.”

That quote stuck with me the first time I heard it. It’s a reminder that in commercial real estate, the endgame matters just as much as your entry point. Too many investors pour all their energy into getting that first property across the finish line only to realize they never thought about where it was actually taking them.

Commercial real estate isn’t just about buying buildings. It’s about building something bigger than yourself: a business, a portfolio, a legacy. Without a clear vision, your investing journey can start to feel like spinning plates, one more deal, one more tenant, one more issue to solve. But with the right long-term strategy, every property becomes a stepping stone toward financial freedom, generational wealth, and impact.

This post isn’t about your next deal. It’s about your last one, the one that makes the whole journey worth it. Whether you’re on property one or property ten, this is your guide to thinking bigger and building a CRE portfolio that lasts.

There’s a certain rhythm to East Nashville — slower than downtown, grittier than the suburbs, and richer in stories than most places you’ll visit in the South. Cross the Cumberland River and you’ll find a neighborhood that’s quietly resisted the gloss of rapid development while still embracing change on its own terms. It’s where musicians, chefs, makers, and misfits all seem to converge — and somehow, it just works.

If you’re looking for a weekend that blends small-town comfort with big-city flavor, East Nashville delivers. The kind of place where you can drink single-origin coffee in a converted garage, shop vintage denim next door to a tattoo parlor, and end the night with world-class cocktails under string lights — all within a few blocks.

Tucked into this creative corridor is the Salt Ranch Hotel, a boutique hideaway that serves as the ideal jumping-off point for exploring East Nashville. It’s not trying to be the scene — it’s quietly part of it. With a design that nods to the neighborhood’s roots and a layout that encourages both solitude and serendipity, it sets the tone for a weekend that’s intentional, immersive, and unmistakably local.

Your 48 hours start here.

Commercial real estate has long been a reliable vehicle for generating passive income, preserving wealth, and leveraging tax advantages. But what happens when the math doesn’t make sense—when cap rates fall below the interest rates you’d pay to finance a deal?

In today's high-rate environment, that's exactly what many investors are facing. With properties still trading at cap rates of 4–6% while borrowing costs sit at 7% or more, the numbers don’t pencil out as easily as they used to. For aspiring and seasoned investors alike, this raises a major question: How do you buy when the deal cash flows don’t work at face value?

Let’s break down what it means when cap rates are lower than interest rates—and five ways you can still acquire profitable commercial real estate in this tough climate.

East Nashville is what the kids are calling - a vibe.

Known for its indie music roots, chef-driven restaurants, and unmistakable creative energy, East is where locals live, artists create, and travelers come to experience a side of Nashville that’s authentically its own. Whether you're catching a show at The Basement East, sipping coffee at a corner café, or browsing vinyl at Grimey’s, staying on the East Side means being immersed in the heartbeat of Nashville culture.

But with the surge of growth and revitalization, where you stay in East Nashville can shape your entire trip.

Boutique hotels, B&Bs, converted churches, and next-gen hospitality concepts have popped up in every corner—from Five Points to Dickerson Pike. And with the much-anticipated opening of The Salt Ranch, a new destination hotel just minutes from downtown, East Nashville is solidifying itself as the creative traveler’s home base.

This guide breaks down your best options for staying in East Nashville—whether you’re looking for high design, local flavor, extended-stay comfort, or something brand new and buzzy.

Let’s dive into where to stay, why it matters, and how to make the most of your visit.

Real estate stories almost always start the same way.

Someone buys a small property.

They scale quickly.

They raise capital.

They build a portfolio.

They “figure it out.”

Then comes the highlight reel — the exits, the cash flow, the passive income, the generational wealth.

What rarely gets shared is the moment when it almost fell apart.

The missed refinance window.

The lender call that didn’t go as planned.

The project that ran wildly over budget.

The sleepless nights wondering if one bad decision just unraveled five years of progress.

Because struggle doesn’t market well.

Smooth scaling does.

There’s a polished version of growth that makes success look linear — disciplined underwriting, steady expansion, clean transitions from one deal to the next. And while that version is more comfortable to tell, it leaves out something critical:

The pressure.

In reality, scaling in commercial real estate is rarely smooth. It’s lumpy. It’s volatile. It’s capital-intensive. And it often tests your assumptions before it rewards your ambition.

But here’s the part most people don’t understand:

The moments that almost break you are usually the moments that refine you.

There’s a difference between building momentum and building resilience.

Momentum feels like success.

Resilience is built in the moments when momentum disappears.

And sometimes the most important lessons in a developer’s career don’t come from the deals that worked.

They come from the one that almost didn’t.

In this post, we’re unpacking a conversation about what “almost breaking” teaches you — about leverage, risk, ego, timing, and the invisible structural flaws that success can temporarily hide.

Because there are lessons you simply cannot learn from books.

Only from pressure.