From Eyesore to Asset: Unlocking Wealth in Forgotten Buildings

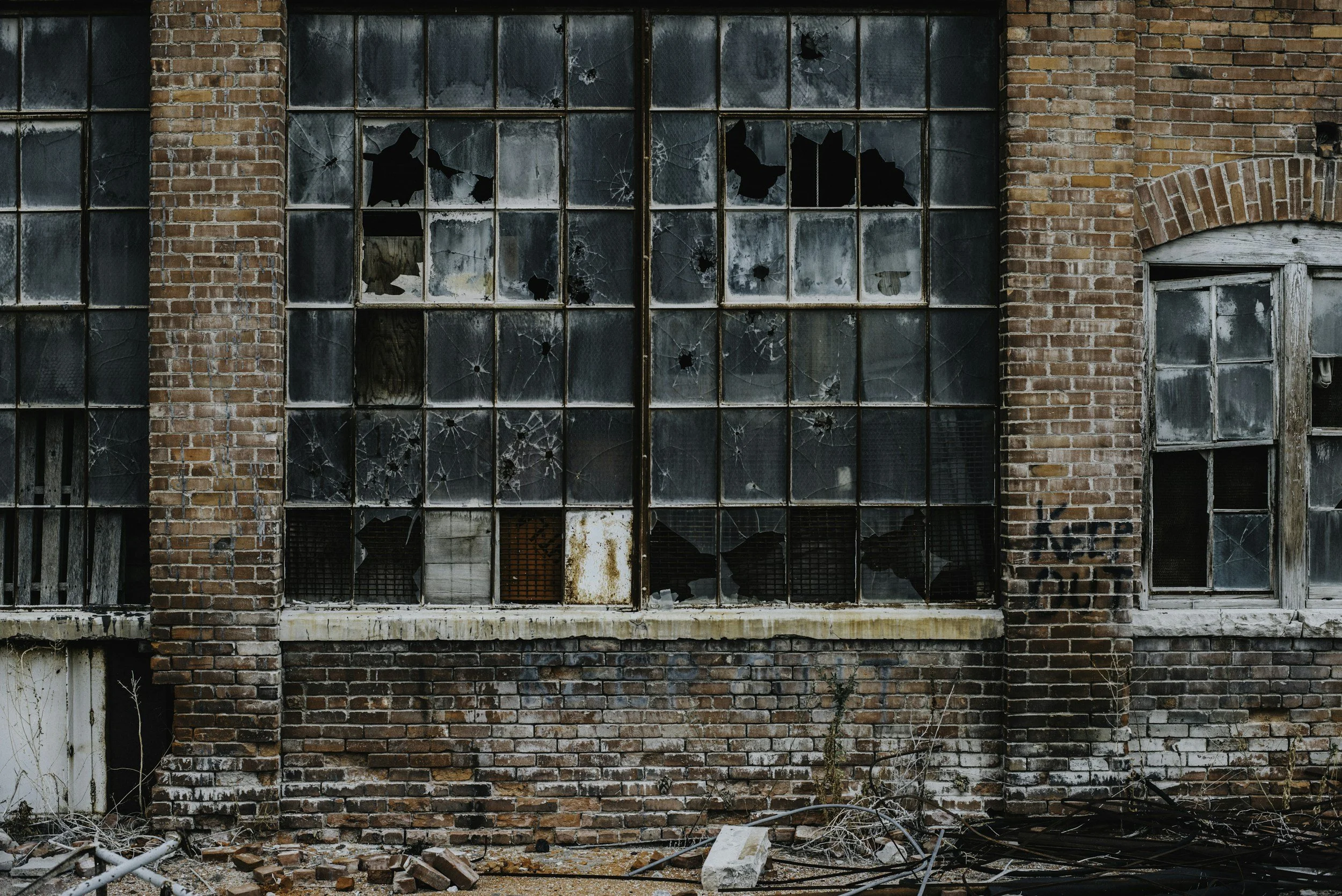

Most investors walk past them without a second glance — the boarded-up strip centers, caved-in warehouses, and overgrown office buildings. They’re seen as too risky, too expensive, too far gone.

But in commercial real estate, the ugliest properties often hide the biggest opportunities.

Over the past few years, Tyler has repositioned more than $75 million worth of forgotten and underperforming buildings — not by chasing perfect assets, but by creating value where others saw failure. One property in East Nashville with a collapsed roof generated over $600,000 in equity before construction even started. Another, a 9-story vacant tower in Chattanooga, went from liability to profitable.

This isn’t house flipping. This is commercial real estate — where value is built through vision, zoning, and execution.

In this post, I’ll walk you through:

Why abandoned buildings are the best-kept secret in commercial real estate

The 3-part framework I use to separate money pits from gold mines

And how you can start seeing upside where others only see problems

Let’s dig into how you turn an eyesore into an asset — and unlock serious wealth in the process.

Property Background: How to Spot Opportunity in “Impossible” Deals

If you’re new to commercial real estate, walking into a boarded-up building with no tenants and a leaking roof might feel like stepping into a money pit. But with the right lens, that property could be your most profitable investment yet.

Let’s break down what to look for — and how to think — using real examples from Tyler’s portfolio.

1. Don’t Judge a Property by Its Condition — Start with Its Potential

📍 Case Study: 12,000 sq. ft. Office Building in South Nashville

At first glance, this building looked unsalvageable — busted HVAC, broken windows, and a layout no tenant wanted. But here’s the key: the building’s value isn’t in what it is today — it’s in what it could become.

In this case, local zoning allowed for more flexible use than most investors realized. That opened the door to repositioning the building for creative office space and short-term rentals — something increasingly in demand in the neighborhood.

Lesson: Always check zoning and entitlement potential before walking away. Use tools like local GIS maps, zoning overlays, and economic development plans to evaluate future use cases.

2. Look for Neighborhood Momentum, Not Just Property Condition

📍 Case Study: 9-Story Tower in Chattanooga

This property had been sitting vacant for years — a 9-story brick tower that most considered too far gone. But what caught my attention wasn’t the building — it was the neighborhood trajectory.

New infrastructure projects, a nearby park development, and slow-but-steady commercial leasing nearby told me this part of downtown was about to change. By getting in early, we positioned the asset for long-term upside.

Lesson: Follow city council agendas, infrastructure investments, and new business openings. Neighborhood trends often matter more than current rent rolls.

These aren’t lucky breaks. They’re the product of a repeatable way of thinking. You’re not just buying a building — you’re buying what that building could become.

In the next section, I’ll walk you through the exact 3-part framework I use to determine if a distressed property is a money pit or a gold mine.

Investment Challenges and innovations: How to separate money pits from gold mines

Not all abandoned buildings are good investments.

Some are money pits that will drain your time, capital, and sanity. Others? They’re sleeping giants, just waiting for the right investor to bring them back to life.

Here’s the 3-part framework I use to determine the difference — and how to creatively overcome the challenges that scare most investors away.

Step 1: Run the Zoning & Use-Case Analysis Before You Ever Swing a Hammer

Zoning is where upside lives.

Most investors don’t even read the code — they see a crumbling building and walk. But if zoning allows for higher-value uses (like converting retail to office or flex to mixed-use), you may be sitting on unrealized value.

✅ Ask yourself:

What is the current zoning?

What other uses are allowed — by-right or with a special exception?

Is there an overlay district offering incentives or density bonuses?

🔧 Example: One property I purchased was zoned for commercial but qualified for adaptive reuse, unlocking short-term rental potential in an area hungry for flexible lodging.

Step 2: Evaluate Incentives and Financial Levers Beyond Purchase Price

Buying cheap doesn’t make it a good deal — buying smart does.

Look into:

Tax abatements (often available in Opportunity Zones or under historic preservation guidelines)

Facade grants and low-interest city-backed loans

Energy efficiency or brownfield credits

✅ Ask yourself:

Is the property in a special economic development zone?

Are there matching grants or forgivable loans available?

Can I use a 1031 exchange or cost segregation?

Step 3: Reverse Engineer the End Value — and Work Backward

Before you buy, know your exit. What will this building be worth once it’s stabilized?

This involves:

Talking to appraisers early

Understanding rent comps and cap rate trends

Factoring in renovation costs, lease-up time, and tenant demand

The Takeaway

Investing in distressed commercial real estate is not about guessing. It’s about asking the right questions — and stacking the upside in your favor.

If you can master these three steps, you’ll start to see what most investors miss: the blueprint for turning trash into treasure.

In the next section, we’ll explore how operations and execution turn that vision into real dollars — and real returns.

Impact of operational changes: how execution turns potential into profit

Identifying upside is just the first move. Operational strategy is where the value is realized.

This is how Tyler manages the post-acquisition phase to actually extract the equity that was “trapped” in the property — without wasting time, money, or energy.

1. Start with the End in Mind — and Build Backwards

Before touching anything, I define the future state of the property:

What tenants are we targeting?

What kind of NOI (net operating income) do we need to hit our value goals?

What does that mean in terms of layout, parking, finish level, and timeline?

From there, I work backward into the budget and construction schedule.

💡 Pro Tip: Don’t overbuild. On one flex space development, Tyler purposely scaled down office buildouts because tenants wanted cheaper rents — not luxury finishes.

2. Make Strategic Upgrades That Influence Appraisal Value

Not all improvements are equal. Focus on upgrades that:

Improve the income-generating potential (e.g., adding roll-up doors or dividing spaces for multi-tenant use)

Increase marketability to better tenants

Trigger higher appraisal comps (e.g., changing use from warehouse to creative office)

📍 Example: In one project, simply shifting the use type through rezoning increased Tyler’s projected appraisal value — without pouring a dime into construction yet.

3. Lease Smart, Not Fast

A common trap: rushing to lease the space to the first tenant that comes along. Instead:

Wait for anchor tenants who legitimize the project and set a strong rent floor

Consider staggered lease terms to protect future upside

Evaluate CAM structure (common area maintenance) to make sure operations don’t erode your NOI

4. Systematize Property Management — or Outsource It Well

Passive income only works if the property is well-run. That means:

Clear SOPs for maintenance, rent collection, and tenant communication

Hiring reliable third-party managers if you don’t want to run ops

Creating dashboards for tracking cash flow and performance

Execution Is the Multiplier

The best acquisition strategy in the world means nothing without operational excellence. Your returns — and your reputation — will live or die based on how well you run what you buy.

In the next section, we’ll talk about the emotional and strategic “why” behind these deals — and why the story of a property matters just as much as its spreadsheet.

The Heart of the Property: Seeing Value Where Others See Failure

Every distressed property has a story.

Sometimes it’s decades of neglect. Other times it’s a failed development, a fire, or a market that left it behind. But behind every boarded-up window is a history — and a future that someone needs to believe in first. That someone is you.

Why Vision Is the Most Valuable Skill in Commercial Real Estate

Anyone can underwrite a stabilized deal. What separates elite investors is the ability to see potential before the market catches on.

Transformations Aren’t Just Financial — They’re Emotional

These projects are more than spreadsheets. You’re not just renovating a building — you’re rewriting its future in the community.

A vacant tower becomes a downtown landmark.

A forgotten retail strip turns into a flex space hub for local businesses.

A collapsing roof becomes a multi-tenant asset with six figures in built-in equity.

And along the way, the neighborhood benefits — new jobs, new services, new life.

Why This Matters for New Investors

You might not have millions in capital or years of experience. But you can learn to spot the story behind a building — and align it with what the market needs next.

That’s where real deals are born. Not on LoopNet. Not in broker blasts. But in the ability to look at a property and say: “I know exactly what this could become.”

Next, we’ll bring it all together — and talk about how these transformations lead to long-term wealth, time freedom, and a legacy far beyond your first deal.

Long-Term Vision and Legacy: Why We Don’t Just Build Buildings — We Build Wealth

When people hear about $600K in equity before construction or a $400K purchase turning into a $1M valuation, they think this game is about fast flips or big wins.

But that’s not the mission.

This is about building something bigger — a commercial real estate portfolio that pays you forever, that grows over time, and that you can eventually pass down.

The End Game Isn’t a Payday — It’s Freedom

Every repositioned property becomes a building block for:

Passive income that supports your lifestyle

Refinancing and equity takeouts to fuel the next deal

Tax advantages that supercharge your returns

Control over your time, your work, and your future

When you stack these deals over time, your portfolio starts working harder than you do. And that’s when real estate shifts from a hustle to a legacy.

Why I Teach This (and Why Most Won’t)

Tyler built a multi-million dollar portfolio not by playing it safe, but by leaning into buildings other people ignored.

Today, he teaches this system through the CRE Accelerator, where he helps new and experienced investors:

Source off-market deals

Underwrite creative value-add plays

Navigate zoning and incentives

Avoid fatal mistakes during renovations and leasing

And ultimately, close their first (or next) commercial deal

Because anyone — regardless of experience — can build generational wealth through commercial real estate. You just need the right roadmap.

Closing Thoughts: Where to Start

If you’ve been thinking about getting into commercial real estate but felt overwhelmed, this is your invitation.

You don’t need to know everything. You just need to know how to:

See what others miss

Ask better questions

And commit to learning the process

Start with one building. One neighborhood. One deal that makes sense to you.

Because that one “eyesore” might just be the most valuable asset you’ll ever buy.

For those interested in delving deeper into commercial real estate investing, check out our course offerings. The courses provide in-depth insights, real-world case studies, and practical strategies to help you navigate the complexities of commercial real estate and achieve success in your ventures. Whether you're a seasoned investor or just starting in the world of commercial real estate, there's always more to learn. Equip yourself with the knowledge and tools you need to thrive in commercial real estate!

In 2008, the city of Chicago sold off the rights to 36,000 parking meters for $1.15 billion. At the time, officials praised it as a financial lifeline—a way to plug a massive budget deficit without raising property taxes. But by 2025, the investors behind that deal had already earned back every dollar… plus $500 million in profit. And the kicker? They still had 60 years left on the contract.

Chicago didn’t just lose out—it got absolutely fleeced.

This wasn’t a one-off oversight. It was a glaring case of what happens when institutional leaders misunderstand the quiet power of boring real estate. Because what looked like an outdated relic—coin-operated meters on slabs of city asphalt—turned out to be one of the most lucrative investments in modern American history.

But this story isn’t really about Chicago. It’s about the invisible empire that grew underneath America’s cities—parking lots, storage yards, fenced land—and the people who saw their value long before Wall Street did.

The investors who win in commercial real estate aren’t always the ones chasing the flashiest properties. They’re often the ones who ask the simplest question: “Can I charge rent on that?”

This is the story of how surplus land and painted asphalt built billion-dollar fortunes—and how the exact same principle is quietly shaping the next wave of wealth in commercial real estate.