Common Area Maintenance: What You Need to Know about CAM

Commercial real estate is full of industry jargon.

Terms get tossed around like they’re common English – triple net, cap rate, CAM.

Whether you’re looking to lease or invest in commercial properties, you’ve likely encountered the term CAM before.

Here’s what you need to know:

What is Common Area Maintenance?

Common area maintenance is an additional rent expense intended to cover any expenses involved with day to day operations of the property.

As an additional rent expense, it is not intended to be a profit-center for your landlord and makes up one of the three “nets” in triple net (NNN).

What Is Common Area?

Any space that is commonly used between two or more tenants is considered “common area,” meaning one tenant doesn’t have exclusive access to that space.

But someone has to take responsibility for maintaining that area, right?

Maintaining the Common Area

Instead of the tenants arguing over who is responsible for taking care of the common areas, the responsibility falls to the landlord and / or property management company.

They collect those fees from tenants and oversee the management of the space.

These expenses are typically covered thoroughly in your commercial lease so that there is little to no ambiguity as to where the landlord’s responsibility drops off and the tenant’s responsibility picks up.

There is no standard set of expenses.

So, whether you’re a tenant or a landlord, it’s important to consult with your attorney to ensure that everything you expect to see is appropriately covered in the lease.

What is Included in CAM?

Unfortunately, like many aspects of commercial leases, there aren’t any “standards.”

The management requirements will vary from building to building depending on:

Property Type

Number of Tenants

The Property’s Layout

Building Age

Regional Climate

Property Class

Landlords and tenants will negotiate these charges prior to executing a lease.

So, the charges may change from lease to lease, but they’re often very set in stone.

After all, landscaping is landscaping, window washing is window washing.

However, it is possible to cap how much these expenses can fluctuate from year to year, which we’ll cover later in the article.

Two Types of CAM

Common area maintenance can be broken down into two separate categories: controllable and uncontrollable expenses – very creative names, I know.

Controllable expenses include anything that the landlord will actually have control over, such as janitorial supplies or parking lot maintenance.

Uncontrollable expenses, on the other hand, are out of the landlord’s influence and include items like property taxes and building insurance.

Common Charges You’ll Find

Some services that you will often find billed to tenants include:

Administrative and Management

Advertising and Marketing

Electric

Elevators

General Building Maintenance

Janitorial

Landscaping

Lighting

Parking Lot Maintenance

Security

Sidewalks

Water

Window Washing

Keep in mind that this list is not all-inclusive and every property has its own specific common area items.

How is CAM Calculated?

CAM is typically calculated on an annual basis and billed to the tenants monthly with rent.

Since it is often just an estimate of the actual expenses, property managers and owners will base these numbers off the last year’s actual expenses for their annual budget.

How Tenants are Charged

The total common area maintenance estimate is then divided proportionally to each tenant of the building based on square footage.

The tenant’s pro rata share is calculated by dividing their square footage by the total leasable area of the building.

To make this additional rent expense easier for tenants to manage, landlords will charge a smaller amount on a monthly basis.

Annual Reconciliation

At the end of each year, the property manager or owner of the building will reconcile the charges.

They compare the budget to the actual costs to determine what the true expenses were for the year.

If the expenses turn out to be less than what was estimated at the beginning of the year, then the tenant will be given a credit for their over-payment.

However, if CAM turned out to be more expensive than estimated, the tenants will be responsible for making up the difference.

Budgeting Best Practices

In my experience, it’s better to overestimate what the expenses will be for the year.

The landlord will be able to reimburse tenants for their over-payment instead of having to bill them to cover the actual costs at the end of the year.

Much easier for tenants to handle.

What Types of Properties Have Common Area Maintenance?

Additional rent charges can be found in just about any type of property.

The entire premise for these fees is to ensure that any expenses associated with the areas that are shared between tenants are managed and appropriately charged.

These charges aren’t just found on any property that has multiple tenants.

CAM can also be found in shopping centers and office parks with multiple different owners that are governed by a Property Owners Association (POA), similar to a Homeowners Association.

Therefore, common area maintenance charges can be found in:

Retail

Office

Industrial

Hospitality

Multifamily

And any other type of commercial real estate

Capping Total Expenses

Common area expenses can widely vary from property to property.

And if they’re not properly managed, they can get out of hand and become quite costly.

While the additional rent isn’t exactly negotiable, tenants can put a cap on their responsibility.

How CAM Caps and Floors Are Handled

To do so, some leases will have “caps” or “floors” with regards to how much these expenses may fluctuate on an annual basis.

These caps are often presented as a percentage of the total charges. For example:

Tenant shall be responsible for its pro rata share of any increase in Operating Costs for the Building above the base year 2020, which shall not increase more than 5% annually.

Depending on how the clauses are worded or negotiated, these annual increases may be cumulative or compounded.

What Caps and Floors Accomplish

If the actual charges end up being lower than the cap, then the cap does not take effect.

On the reverse end, landlords do not typically have a “minimum” common area maintenance factor cap.

These caps are intended to ensure that the management company or owner for the building is being responsible with the money spent on maintaining common areas.

Tips for Tenants

Determine What is Actually Covered

It’s important to determine exactly what is involved and covered in CAM.

Landlords and management companies will typically want the definition of common area maintenance to be as broad and all-encompassing as possible, which will give them flexibility in maintaining and managing the property.

Tenants, on the other hand, will want to restrict what is considered their portion of the common area and therefor what is their responsibility.

Common area charges are often the most heavily negotiated and scrutinized aspects of commercial leases.

These fees are not intended to help pay for tenant build-outs and other tenant-specific uses.

Any capital expenditures, property management fees, salaries paid to any employees of the property, leasing commissions and fees, etc. should be investigated to ensure that those charges are appropriately spent on maintaining the common areas of the property.

It’s not common, but it’s also not unheard of that property owners will pass 100% of an employees salary onto a shopping center when that employee only spends 30% of their time working on that property.

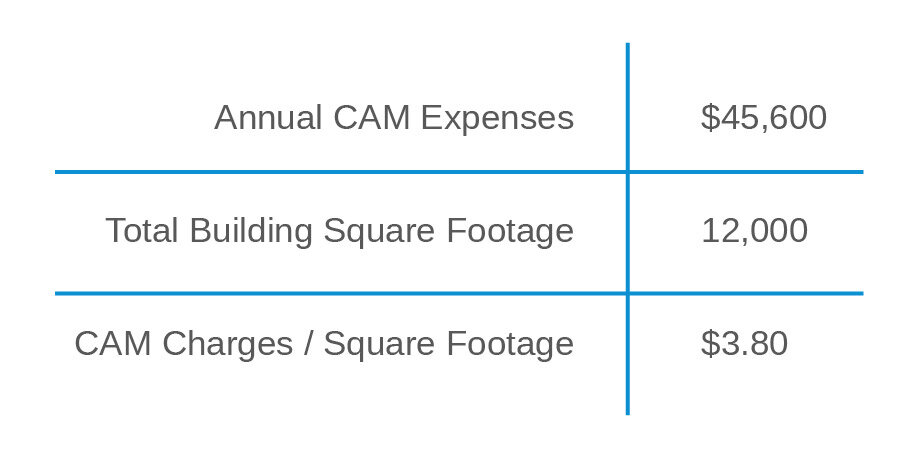

Calculating a Tenant’s Proportionate Share of Common Area Maintenance

How is the tenant’s portion of the common area maintenance costs determined?

This costs are typically charged on a square foot basis for the entire property.

So, total annual costs are calculated, divided up by the total rentable square footage of the property, and doled out to tenants in an “$X.00 per sq. ft.” basis.

In order to calculate the true liability of each tenant, it’s crucial to have the correct square footage leased by each tenant. After all, if these numbers are off, some tenants will be paying a higher or lower portion than their pro rata share.

Tenants and landlords will certainly want to double check these numbers to ensure that the correct amount of reimbursements are being paid / received.

Tips For Property Owners / Managers

Control Maintenance Costs

If your maintenance charges are capped, you’ll certainly want to control your costs so that you don’t go over budget.

Having a go-to maintenance crew, if not in-house, can help with these expenses.

By regularly inspecting the property, you’ll be able to plan out which items need to be taken care of now and what can be put off until later.

Having a timeline and schedule for when these items will be maintained and / or replaced will certainly prevent unexpected maintenance costs and help keep you and your team within budget.

Conduct Preventative Maintenance

Instead of waiting until some aspect of the property breaks down or truly becomes an issue prior to fixing it, conduct preventative maintenance.

If you ignore a slightly leaking pipe until it has caused the entire ceiling to collapse in, you now have a much bigger (and costlier) issue at hand.

Taking this approach to maintaining your property will not only keep the property in better shape, it will help strengthen your relationship with you tenants. Once you’ve found a tenant for your property, you will want them to see that you’re actively working to improve or maintain their workspace.

share This Article:

About The Author:

Tyler Cauble, Founder & President of The Cauble Group, is a commercial real estate broker and investor based in East Nashville. He’s the best selling author of Open for Business: The Insider’s Guide to Leasing Commercial Real Estate and has focused his career on serving commercial real estate investors as a board member for the Real Estate Investors of Nashville. Learn more at www.TylerCauble.com

Commercial real estate investing can be a pretty rewarding venture, offering the potential for substantial returns and long-term wealth creation. From office buildings and retail spaces to apartment complexes and industrial warehouses, the commercial real estate market presents diverse opportunities for investors willing to navigate its complexities.

However, like any investment, commercial real estate comes with its own set of risks. For new investors, understanding and managing these risks is crucial to achieving success and avoiding costly mistakes. The world of commercial real estate can be unforgiving to the unprepared, making risk management an essential skill for anyone looking to enter this market.