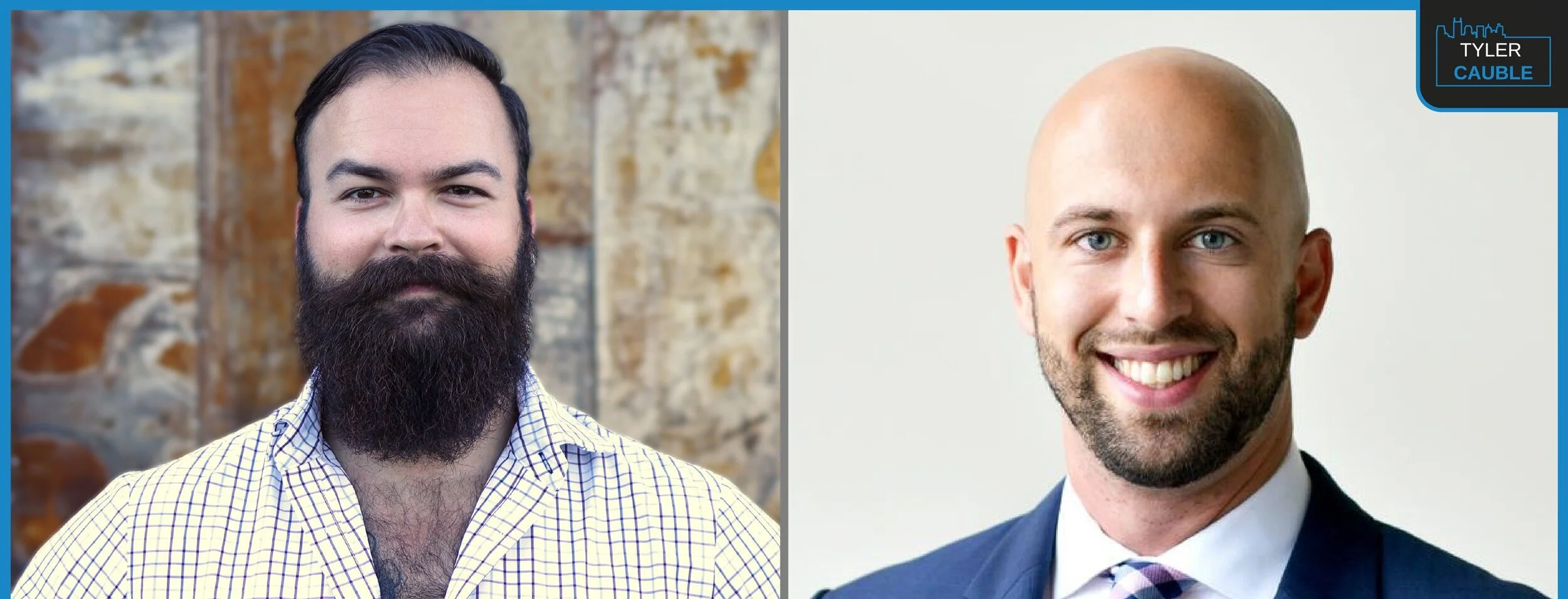

Multifamily Brokerage to Syndication with Tyler Chesser

Tyler Chesser, CCIM, is an experienced multifamily real estate investor, in an active and passive capacity, and has witnessed firsthand the successes and failures of building a real estate portfolio. Tyler is the Founder of The Chesser Companies where he works with leaders, entrepreneurs and real estate investor clients as a peak performance coach and world class consultant; he’s a high performance coach, additionally providing group coaching services through Elevate High Performance Coaching Academy, he’s also the Co-Founder of CF Capital, a real estate private equity firm, which focuses on acquiring and repositioning multifamily assets in the Southeast United States and provides institutional-quality services to its residents and outsized returns to its investment partners.

What if the most distressed buildings in your market don’t look distressed at all?

Some of the best off-market deals never hit LoopNet. They don’t show up in broker chatter. And on paper, they look “occupied.”

But the lights tell a different story.

In this breakdown, I dive into a fascinating strategy investors are using to uncover hidden vacancy by analyzing something most people ignore: energy usage. By comparing reported occupancy to actual electricity and utility consumption, you can spot buildings that are quietly bleeding—long before the market catches on.

Why did Starbucks ignore the billion-dollar real estate playbook that made McDonald’s rich?

Ray Kroc built McDonald’s into a $40+ billion property empire by owning the land under his restaurants. Howard Schultz knew that strategy… and deliberately did the opposite.

Heading into 2026, a lot of investors are still operating like it’s 2019—assuming industrial will bail them out, multifamily will never crack, and Silicon Valley will somehow innovate its way past fundamentals. But markets don’t reward nostalgia. They reward awareness. If you’re holding real exposure in today’s CRE landscape—whether that’s flex, medical, industrial, or even legacy office—your edge won’t come from speed. It’ll come from knowing which signals actually matter before the institutional money prices it in.

Most investors hit this point and keep moving as if every cycle works the same. That’s how portfolios grow… and quietly destabilize. Because what separates those who compound through volatility from those who stall isn’t hustle. It’s structure—understanding where demand is forming, which sectors are insulated, how freight and logistics are shifting, and what rising delinquencies are really telling you about capital risk in 2026. If you want next year to work for you instead of happening to you, you need to stop treating headlines like entertainment and start treating them like strategy.

Making real money in commercial real estate isn’t about finding ten different deals. It’s about learning how to get paid ten different ways on one deal. Most investors get stuck in the same cycle: grind to close, park the asset, and wait years for a payday that may or may not show up. Meanwhile, overhead keeps coming, momentum fades, and the business feels way harder than it needs to be. The truth is, if you structure your deals correctly, you can create income at closing, during the hold, and again on the exit—without needing a massive portfolio to survive.

The investors who last in this game aren’t just deal hunters. They’re deal architects. They understand that every transaction has multiple levers: brokerage, fees, operational cash flow, backend upside, and even debt positioning. You won’t stack all of them on every deal, but once you know the menu, you stop being reactive and start building predictable income around your acquisitions. That’s how you keep the lights on while your equity compounds in the background.

Most investors overlook one of the simplest and most profitable business models in commercial real estate: monetizing land.

In 2008, Chicago sold the rights to 36,000 parking meters for $1.15 billion. By 2025, the buyers had already collected every dollar back, plus roughly $500 million in profit, with decades of revenue still ahead. The city did not realize it was sitting on a land based cash flow machine.That deal is a clear reminder of a bigger truth in CRE. Some of the most boring properties quietly outperform the flashy ones.

Starting a family office sounds like something reserved for billionaires, but the truth is the “family office mindset” kicks in way earlier than most people realize. If you’re sitting on a meaningful liquidity event, a paid-off asset, or even a few million in deployable cash, you’re already in the zone where strategy matters more than hustle. The problem is most investors hit that point and keep buying deals the same way they always have—reactive, scattered, and without a real portfolio blueprint. That’s how wealth gets built… and quietly leaks.

Heading into 2026, a lot of investors are still playing the same game they played in 2021: chasing whatever looks hot, reacting to headlines, and hoping the next deal fixes the last one. But markets don’t reward hustle forever. They reward positioning. If you’ve got real exposure in CRE—whether that’s a solid portfolio, meaningful liquidity, or even just a few good assets—you’re already at the point where strategy matters more than speed. The problem is most people hit that level and keep operating without a blueprint. That’s how returns get built… and quietly leak.

Flex space is heating up while most investors are still looking the other way. Headlines talk about industrial slowing, but small bay units between 2,000 and 6,000 square feet are leasing faster than they hit the market. Even older buildings in average locations are getting multiple offers. Years of underbuilding and redevelopment wiped out supply, yet the businesses that rely on these spaces never disappeared. Demand stayed strong. Inventory didn’t.

What if I told you one of my friends raised $1,000,000 in just 24 hours—for his first solo real estate deal?

No private equity.

No institutional backing.

No track record raising capital alone.

Just one email… backed by years of invisible work.

The headlines say “commercial real estate is cooling”—but the data tells a different story. According to Deloitte’s 2026 Outlook, most investors still expect to increase their CRE exposure over the next 12–18 months. Why? Because in uncertain times, hard assets win.